Trading

Support and Resistance levels in Forex Trading: Identifying Key levels

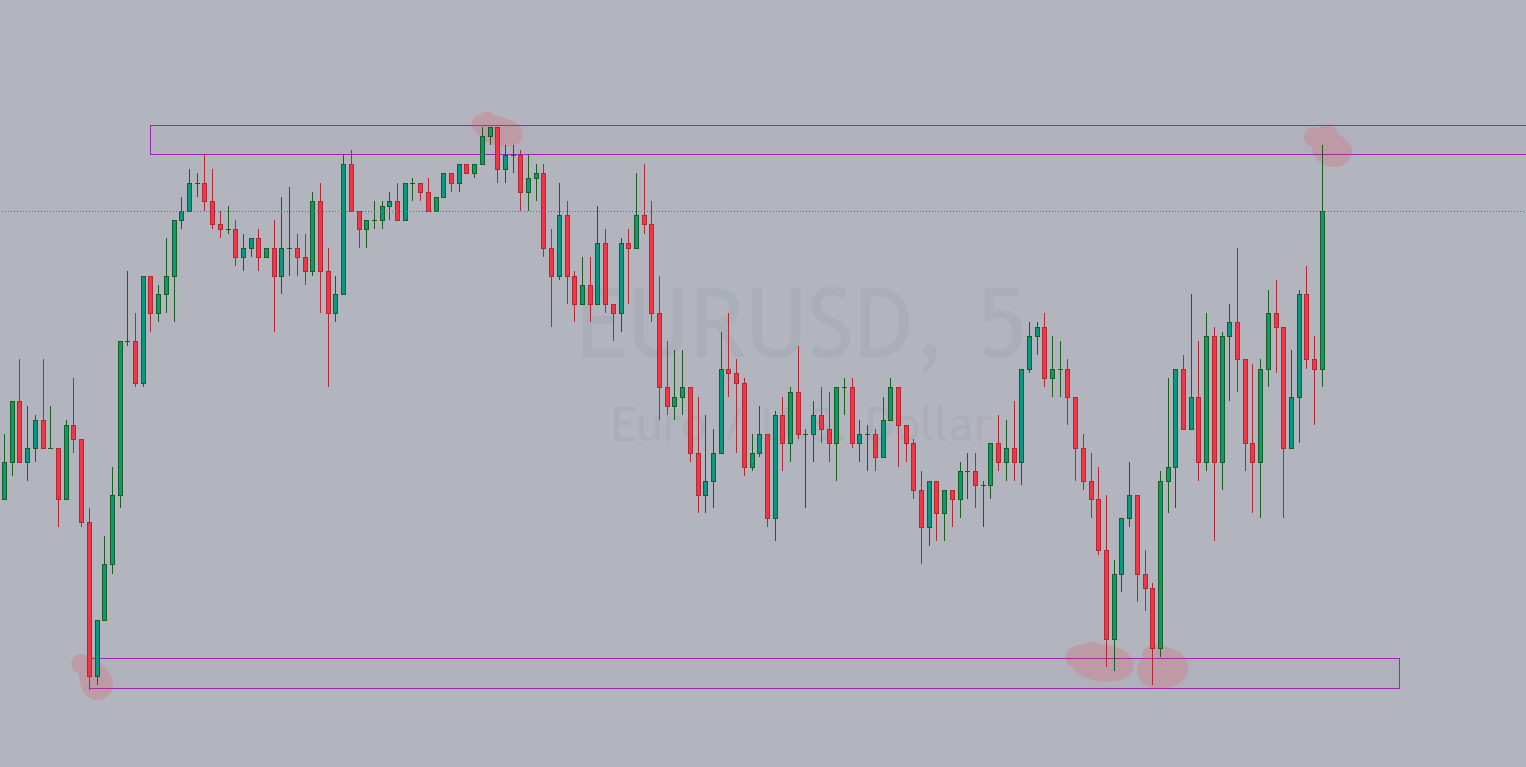

Identifying support and resistance levels is a fundamental aspect of technical analysis in Forex trading. These levels represent areas on a price chart where the price of a currency pair tends to find barriers to further movement, either in the form of support (a floor) or resistance (a ceiling).

Here are several methods traders use to identify support and resistance levels:

- Price Action Analysis: Observing price action is one of the most straightforward methods for identifying support and resistance levels. Traders look for areas where the price has previously reversed direction or consolidated, forming distinct levels where buyers or sellers have shown significant interest. These levels can be identified by looking for clusters of price reversals, swing highs, or swing lows on the chart.

- Horizontal Lines: Traders often draw horizontal lines on the chart to mark key levels. These lines connect multiple price highs or lows, forming a visual barrier on the chart. Horizontal support and resistance levels are considered more significant when they align with historical price levels, such as previous peaks or troughs, or key psychological levels, such as round numbers or whole figures.

Horizontal support and resistance levels

- Trendlines: Trendlines are diagonal lines drawn on the chart to connect consecutive highs or lows in an uptrend or downtrend, respectively. In an uptrend, trendlines act as dynamic support levels, while in a downtrend, they act as dynamic resistance levels. Traders look for instances where the price reacts to trendlines, bouncing off or breaking through them, to identify potential support and resistance levels.

- Moving Averages: Moving averages, such as the simple moving average (SMA) or exponential moving average (EMA), can also act as dynamic support and resistance levels. Traders often use moving averages to identify the underlying trend and potential areas of support or resistance where the price tends to react. For example, the 50-day or 200-day moving average is commonly used as a long-term support or resistance level.

- Fibonacci Retracement Levels: Fibonacci retracement levels are based on the Fibonacci sequence and ratios (e.g., 23.6%, 38.2%, 50.0%, 61.8%, etc.) and are used to identify potential support and resistance levels in a trending market. Traders draw Fibonacci retracement levels from the swing low to the swing high (in an uptrend) or from the swing high to the swing low (in a downtrend) to identify areas where the price may retrace before resuming its trend.

- Volume Profile: Volume Profile is a graphical tool utilized to illustrate the volume traded at different price levels during a designated time-frame. Traders use Volume Profile to identify areas of high trading activity, known as volume-based support and resistance levels. These levels indicate where significant buying or selling pressure has occurred and can serve as potential reversal or continuation points.

Take note that these levels are dynamic and subject to change as market conditions evolve over time. Therefore, traders should regularly review and adjust their analysis to account for new price developments and market dynamics. Additionally, it’s advisable to combine multiple methods of identifying support and resistance levels to confirm their validity and increase the reliability of trading decisions.

Trading

Overcome These 5 Key Problems To Become a Profitable Day Trader

Trading in financial markets, whether it be stocks, forex, or cryptocurrencies, requires more than just understanding market movements and patterns. It demands emotional fortitude, strategic discipline, and a clear mindset. To be a successful and profitable trader, you must confront and overcome several psychological and behavioral hurdles. Here, we delve into the 5 Key Problems you must consider and conquer to thrive in the day trading world.

1. Fear: Overcoming the Dread of Loss

Fear is a natural human emotion, but in trading, it can be a significant impediment. Fear of losing money can lead to hesitancy, resulting in missed opportunities or premature exits from potentially profitable trades. To mitigate fear:

- Develop a Solid Plan: A well-structured trading plan, including risk management strategies, can provide a roadmap and instill confidence.

- Risk Management: Utilize stop-loss orders to limit potential losses and keep your risk per trade within a comfortable threshold.

- Focus on Process, Not Outcomes: Concentrate on executing your strategy rather than fixating on the results of individual trades. This mindset shift can reduce anxiety.

2. Distraction: Avoiding the Noise

In the age of information overload, traders are bombarded with signals, tutorials, and opinions. These distractions can cloud judgment and lead to inconsistent trading practices. To stay focused:

- Filter Information: Select a few reliable sources of market analysis and signals. Avoid jumping from one source to another.

- Create a Routine: Establish a daily routine that includes specific times for analysis, trading, and review. This can help maintain focus and discipline.

- Mindfulness Practices: Techniques such as meditation and mindfulness can enhance concentration and reduce the impact of external distractions.

3. Strategy Switching: Building Confidence in Your Approach

A common pitfall for many traders is the frequent switching of trading strategies due to lack of confidence. This inconsistency can erode potential profits. To avoid this:

- Backtesting: Thoroughly backtest your trading strategies on historical data to gain confidence in their potential effectiveness.

- Commitment: Commit to a chosen strategy for a predefined period before evaluating its performance.

- Continuous Improvement: Instead of switching strategies, focus on refining and optimizing your current approach based on performance reviews.

4. Greed: Cultivating Contentment

Greed, or the insatiable desire for more, can lead to excessive risk-taking and ultimately, significant losses. To manage greed:

- Set Realistic Goals: Define clear, attainable profit targets and stick to them.

- Discipline: Establish rules for taking profits and adhere to them rigorously.

- Reflect and Reward: Regularly reflect on your achievements and reward yourself for meeting your trading goals, reinforcing disciplined behavior.

5. Over-Trading: The Quest for Instant Riches

The allure of quick riches can lead traders to over-trade, which often results in deteriorating performance and higher losses. To combat this:

- Quality Over Quantity: Focus on high-quality trades rather than a high quantity of trades. Patience is key.

- Strict Criteria: Set stringent criteria for entering and exiting trades to ensure that each trade meets your strategic parameters.

- Rest and Recharge: Regular breaks and downtime are essential to maintain a clear and focused mind, preventing impulsive trading decisions.

Finally You can conquer these 5 Key Problems

No matter how best your strategy is, achieving success in trading is as much about mastering one’s psychology and behavior as it is about understanding markets and strategies. By overcoming fear, avoiding distractions, building confidence in your strategy, managing greed, and avoiding over-trading, you can cultivate the mindset and habits necessary for long-term profitability.

Remember, successful trading is a marathon, not a sprint. Patience, discipline, and continuous learning are your best allies on this journey.

Trading

Profitable Laziness: A Guide to Successful Forex Day Trading

In the world of Forex day trading, there’s a prevailing myth that success requires constant vigilance and tireless effort. However, a growing number of traders are debunking this notion by adopting a strategy that might seem paradoxical at first glance: Profitable Laziness.

This approach prioritizes efficiency, patience, and strategic decision-making over constant activity. In this article, we’ll explore the principles and practices of the profitable lazy Forex day trader.

Understanding Profitable Laziness:

At its core, profitable laziness in Forex day trading is about working smarter, not harder. It involves identifying high-probability trading opportunities and maximizing returns while minimizing time and effort spent in front of the screen. Rather than constantly scanning the markets for opportunities, the profitable lazy trader focuses on quality over quantity, waiting patiently for ideal setups.

Key Principles of Profitable Laziness:

- Strategic Planning: Successful lazy traders start their day with a clear plan in mind. They set specific goals, define their risk tolerance, and outline their trading strategy before the market opens. By having a well-defined plan, they avoid impulsive decisions driven by emotions.

- Selective Trading: Instead of jumping into every potential trade, lazy traders are highly selective. They wait for setups that align with their predefined criteria, such as strong trends, clear support and resistance levels, and confluence of technical indicators. By focusing only on the most promising opportunities, they maximize their chances of success.

- Automated Tools: Technology plays a crucial role in the profitable lazy trader’s toolkit. They leverage automation tools such as algorithmic trading systems, trading bots, and automated alerts to streamline their workflow and minimize manual intervention. These tools help them execute trades more efficiently and capitalize on opportunities even when they’re not actively monitoring the markets.

- Risk Management: Lazy trading doesn’t mean reckless trading. Profitable lazy traders prioritize risk management to protect their capital and preserve long-term profitability. They use stop-loss orders, position sizing strategies, and risk-reward ratios to manage their trades effectively and minimize potential losses.

- Patience and Discipline: Perhaps the most important qualities of a profitable lazy trader are patience and discipline. They understand that not every day will present ideal trading opportunities, and they’re willing to wait for the right moment to strike. By staying disciplined and sticking to their trading plan, they avoid the pitfalls of overtrading and impulsive decision-making.

Case Study: The Lazy Trader’s Routine: Let’s take a closer look at a typical day in the life of a profitable lazy Forex day trader:

- Morning Routine: The trader starts the day by reviewing the previous day’s trades and market developments. They update their trading journal, analyze potential setups for the day, and adjust their trading plan accordingly.

- Market Analysis: Rather than constantly monitoring the markets, the trader checks in periodically throughout the day to assess the current market conditions and look for new opportunities. They use automated alerts and trading algorithms to notify them of potential entry and exit points.

- Selective Trading: When they identify a high-probability setup that meets their criteria, the trader executes the trade with confidence, knowing that they’ve done their homework and followed their plan.

- Risk Management: Throughout the day, the trader monitors their open positions, adjusting stop-loss orders and taking profits as necessary to manage risk and lock in gains.

- End-of-Day Review: Before wrapping up for the day, the trader conducts a thorough review of their trades and performance. They identify strengths and weaknesses, learn from their mistakes, and make any necessary adjustments to their strategy for the next trading day.

Conclusion:

Profitable laziness is not about cutting corners or taking shortcuts; it’s about maximizing efficiency and effectiveness in Forex day trading. By adopting a strategic approach focused on quality over quantity, leveraging technology, and prioritizing risk management and discipline, lazy traders can achieve consistent profitability while enjoying more free time and less stress.

So, if you’re tired of the hustle and bustle of traditional day trading, consider embracing the art of profitable laziness for a more sustainable and enjoyable trading experience.

Trading

Automated Trading Systems: The Pros and Cons of Trading Bot in Forex

In the dynamic world of Forex trading, automated trading systems also know as Trading Bots have emerged as a powerful tool for traders seeking to optimize their strategies and streamline their processes.

These systems, also known as trading bot, algorithmic trading or black-box trading, utilize pre-programmed algorithms to execute trades on behalf of the trader. While they offer a range of benefits, they also come with their own set of challenges. Let’s delve into the advantages and disadvantages of automated trading systems in Forex.

Advantages:

- Emotion-Free Trading: One of the biggest advantages of trading bot/automated trading systems is their ability to remove emotions from the trading process. Fear and greed, common pitfalls for human traders, can often lead to impulsive decisions and poor outcomes. Automated systems execute trades based solely on predetermined criteria, eliminating emotional biases and ensuring disciplined trading.

- Backtesting and Optimization: Automated trading systems allow traders to backtest their strategies using historical data. This enables traders to assess the performance of their strategies under various market conditions and refine them for optimal results. By identifying patterns and trends, traders can fine-tune their algorithms to enhance profitability.

- 24/7 Trading: Unlike human traders who need rest, automated trading systems can operate around the clock, taking advantage of trading opportunities in different time zones. This ensures that traders do not miss out on potential profit-making opportunities, even while they sleep or are otherwise occupied.

- Speed and Efficiency: Automated trading systems can execute trades at lightning-fast speeds, much faster than human traders can react. This allows for timely order placement and fills, minimizing slippage and maximizing profit potential. Moreover, automated systems can simultaneously monitor multiple currency pairs and execute trades across various markets, enhancing efficiency.

- Consistency: Automated trading systems adhere strictly to predefined rules and parameters, ensuring consistency in trading decisions. This consistency helps traders avoid impulsive and irrational decisions that can result from human emotions or fatigue, leading to more stable and predictable outcomes over time.

Disadvantages:

- Complexity and Learning Curve: Developing and implementing an automated trading system requires a deep understanding of programming, algorithms, and market dynamics. For traders without technical expertise, navigating the complexities of building and maintaining such systems can be challenging and time-consuming.

- Over-Optimization: While backtesting is a valuable tool for refining trading strategies, there is a risk of over-optimization. Traders may inadvertently tailor their algorithms too closely to historical data, leading to strategies that perform well in the past but fail to adapt to changing market conditions. This can result in poor performance in live trading.

- Technical Failures and Glitches: Automated trading systems are susceptible to technical failures and glitches, which can disrupt trading operations and lead to significant losses. Connectivity issues, system crashes, or bugs in the code can all impact the performance of automated systems, highlighting the importance of robust risk management protocols.

- Lack of Human Judgment: While automated trading systems excel at executing predefined rules, they lack the human judgment and intuition that can sometimes be crucial in navigating complex and unpredictable market conditions. There may be instances where human intervention is necessary to override automated trading decisions based on nuanced market analysis or geopolitical events.

- Costs and Maintenance: Building and maintaining an automated trading system can incur significant costs, including software development, data feeds, and infrastructure expenses. Additionally, ongoing monitoring and updates are required to ensure the system remains effective and adapts to evolving market conditions.

In conclusion, trading bot offer a range of advantages, including emotion-free trading, backtesting capabilities, and 24/7 operation. However, they also pose challenges such as complexity, over-optimization, and technical failures.

Traders should carefully weigh the pros and cons and consider their individual trading goals and preferences before incorporating automated systems into their Forex trading strategies. Ultimately, a balanced approach that combines automation with human oversight may yield the best results in the dynamic and ever-evolving world of Forex trading.

-

Trading1 year ago

Trading1 year agoAn Overview for Newcomers to Forex Trading: Navigating the Market

-

Trading12 months ago

Trading12 months agoAutomated Trading Systems: The Pros and Cons of Trading Bot in Forex

-

Trading12 months ago

Trading12 months agoHow to Be Lazy and Still Make Money from Day Trading the Forex Market

-

Trading12 months ago

Trading12 months agoProfitable Laziness: A Guide to Successful Forex Day Trading

-

General11 months ago

General11 months agoTrue Forex Funds (TFF) shut down: What Happened and What to Do Next

-

Trading12 months ago

Trading12 months agoSteps to Success and Mastering in the Forex and Crypto Trading space

-

Trading10 months ago

Trading10 months agoOvercome These 5 Key Problems To Become a Profitable Day Trader

-

Trading1 year ago

Trading1 year agoThe Importance of Money Management in Forex: Protecting Your Capital and Growing Your Profits